“ERMA was the absolute beginning of the mechanization of business.”

– Thomas Morrin, SRI Director of Engineering

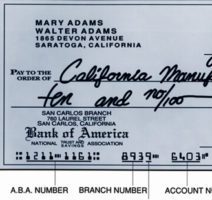

SRI revolutionized banking with the inventions of ERMA (Electronic Recording Machine, Accounting) and magnetic ink character recognition (MICR). Together they replaced laborious manual record keeping with automatic processing of bank and traveler’s checks.

Introduced by Bank of America in 1955, these innovations launched data processing machines for business. MICR is still used worldwide today for reading and processing checks.

Development begins-

SRI’s “whiz kids” get to work

Need for Speed

In 1950, Bank of America was the largest bank in the world. Senior Vice President S. Clark Beise, a leader in machine-based innovations, recognized that check handling and customer satisfaction were the major factors limiting the growth of the bank business. An experienced bookkeeper could post 245 accounts in an hour, about 2,000 in an eight-hour workday, and approximately 10,000 per week.

At that time, Bank of America’s checking accounts were growing at a staggering rate of 23,000 per month and banks were being forced to close their doors by 2 p.m. to perform the proofing and processing necessary to finish daily postings. Automation was essential to keep pace with the growing business. However, business equipment manufacturers did not want to invest in creating a new electronic banking system.

Through interactions with SRI’s Weldon B. Gibson and Thomas H. Morrin, the director of engineering, Beise realized that SRI could act as the Bank’s R&D arm to support automation efforts, including building the prototype for an electronic bookkeeping machine. In a five-year relationship, SRI and Bank of America collaborated to redefine conventions and automate the handling and posting of checks. This work was confidential – only those working on the project knew about it.

Evaluating Automation

The “whiz kids,” as the bank called the SRI team members, weighed the requirements of the new bookkeeping system against the available technology. The few computers in existence had nothing to do with accounting. Transistors were just becoming available but were very unreliable, and large and fast magnetic media were limited to magnetic drums. There was a lengthy discussion about the kind of technology that would be feasible.

SRI immediately pointed out that the blank checks used at that time carried no individual identification and were passed around for anyone to use. Because accounts were kept alphabetically, the addition of an account caused an awkward reshuffling of entire account listings. The checks themselves required changes, and at SRI’s urging, the bank agreed to use account numbers and preprint them on all checks. Each new account would simply be added to the end of an account list, while all preceding numbers were left intact. Once the bank accepted this new concept, the formerly unmanageable and separate processes of proofing and bookkeeping were combined.

Building the System

Through much of the initial feasibility study, SRI did not foresee actually building a system. In September 1950, the SRI team reported that it could build an automatic bookkeeping system meeting the bank’s requirements. To build the new system, called an Electronic Recording Machine, Accounting (ERMA), Morrin proposed a three-phase approach: to study banking procedures external to the machine, to create the general design, and to build and test the system. An equipment manufacturer would execute the last step.

In mid-November 1950, the bank awarded SRI $15,000 over six months to complete the first two phases of the project. The bank paid an additional $5,000 in April 1951, but the total amount was still a small sum for such a large undertaking. The interim report was delivered on time, on April 30, 1951.

But even with this new insight, Bank of America still could not convince its traditional equipment providers of the opportunity ERMA offered. Therefore, the bank convinced SRI to build a demonstration system. SRI signed a contract for $875,000 to complete the project’s third phase by January 1952.

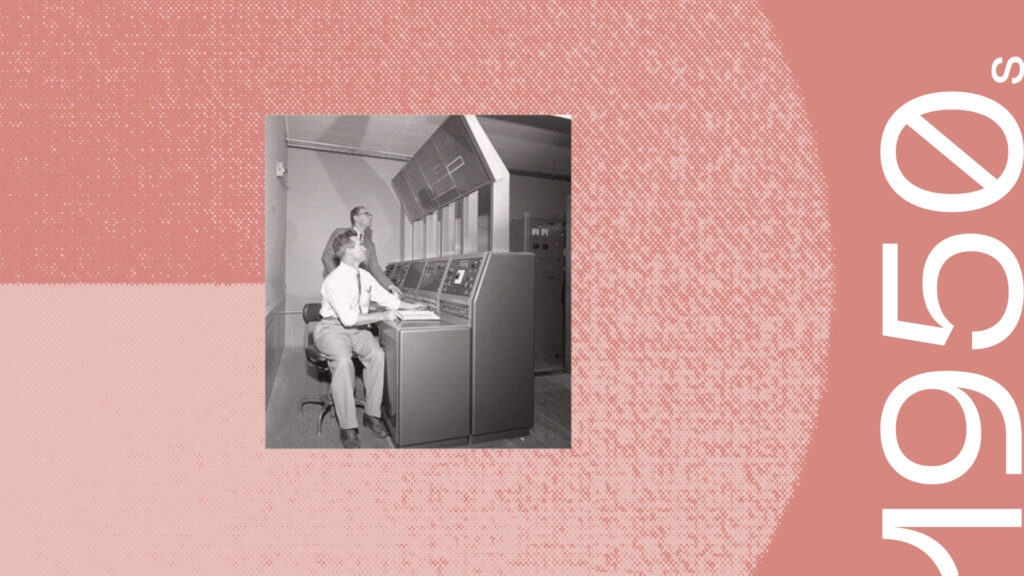

The ERMA computer

A Tour de Force

The first ERMA, which was developed between 1950 and 1955, was a tour de force of engineering skill and ingenuity. The machine was reliable and accurate, even though the technologies needed were in a state of flux and no existing system had the required functionality.

At the time, computer evolution was in its infant stage. Stored-program computers were less than two years old and still in a laboratory state. “Whirlwind,” the first real-time computer, was just being assembled at the Massachusetts Institute of Technology. It used magnetic core memory — a technology that was not available to SRI.

ERMA used magnetic drums and tapes for storage, and vacuum tubes, silicon diodes, and relays for logic. Unlike other batch-mode machines of the period, ERMA made account data available online to validate input and respond to inquiries about account status. Moreover, because a single machine served multiple users simultaneously, it was one of the first time-sharing computers.

MICR

SRI invents the magnetic ink font used worldwide to this day for automatic check processing

Building the System

A second major innovation in the ERMA project was the preprinting of checks with account numbers that could be read automatically and manually with great fidelity, thanks to a machine-readable font using magnetic ink.

At that time, the back of each check contained account information that was imprinted through either an optical or a magnetic bar code. During the ERMA project, Bank of America considered purchasing an optical reading system from a company in Arlington, Virginia, that had developed one of the first optical character readers. But optical methods were too susceptible to overwriting by check cancellations or other incidental marks, and humans could not read optical bar codes. SRI faced these problems when dealing with the automatic sorting of traveler’s checks for the bank.

To avoid these optical problems, Ken Eldredge, who directed SRI’s Control Systems Laboratory, invented a magnetic ink font consisting of numeric and ancillary characters. The account number, now displayed with magnetic-ink font characters that were readable by both humans and machines, was moved to the front of the check. Magnetic Ink Character Recognition (MICR) is still used worldwide today for processing checks.

SRI was issued U.S. Patent Number 3,000,000 for its invention, which was assigned to General Electric. It has been said that because of the importance of the invention, the patent office delayed issuing a patent number until this landmark patent number could be applied. Representatives of the patent office traveled to SRI’s headquarters in Menlo Park, California, to present the patent in person.

Final Hurdles

When it was time for ERMA to go to production, 24 companies were interested in bidding on the job, according to Jerre Noe, SRI’s assistant director of engineering. Once General Electric (GE) won the competition in 1956, its Industrial Computer Section pondered the market for ERMA, and it simultaneously contracted SRI’s business group to examine the banking industry and other related industries and to estimate the total market for ERMA. This research was essential because ERMA represented GE’s entry into the computer field.

SRI technically supported ERMA production design at GE until 1957 or 1958. ERMA cost the bank about $10 million. SRI’s billed costs to GE over the transition were less than $1 million. In August 1957, SRI received a contract from GE for the transfer of the SRI ERMA prototype in exchange for $5,500.

The first GE-produced ERMA system was installed at Bank of America in 1959. The unit included a sorter/reader, a computer, magnetic tape units, and a high-speed printer. During the following two years, an additional 32 systems were installed, and by 1966, 12 regional ERMA centers served all but 21 of Bank of America’s 900 branches. The centers handled more than 750 million checks a year — close to the number predicted for 1970.

Without ERMA, the bank industry would have failed to meet the demands for account updates and account access of a rapidly growing customer base.

The team

Many project participants shared the feeling that this effort was historic.

In almost every respect, the ERMA project was a team effort, in part because it required so many different skills. Most project participants shared the feeling that this effort was historic, although no one could foresee the exact nature or pace of computer applications and computer research.

The technology that team members had to deal with was new and in flux. They made design decisions with great uncertainty about the future of hardware devices, and they lacked tools for logic design and programming. So they experimented with new devices and developed their own design techniques. All of these factors made ERMA an exciting experience for SRI engineers and fueled the effort needed for its success.

The ERMA project team was formed in 1950 and changed in composition over the following eight years, depending on project requirements. Tom Morrin was responsible for the overall project and interfaced with Clark Beise from Bank of America. The technical leadership fell to Jerre Noe, assistant director of engineering, and his technical counterpart at the bank was Charles Conroy. The project was also supervised by SRI’s Ken Eldredge, Byron Bennett, and Oliver Whitby. Their collective job was to make the system components work together.

Al Zipf also deserves recognition for helping Magnetic Ink Character Recognition become the standard font of the American Banking Association and for overseeing the transfer of the SRI prototype for production at GE. He later became Bank of America’s chief technical officer and spearheaded efforts for the automation of banking.

Read our 75th anniversary blog feature

75 years of innovation: Banking automation ERMA